Feeling like investing is only for the rich? Think again. A Raiz Invest review could open up a whole new financial world for you, right on your phone.

The app has changed how Aussies think about making money. Launched in 2016, Raiz Invest lets you start investing with just $5. It’s breaking down old money-making barriers.

With over 500,000 users and about $1 billion managed, Raiz is a big deal. It’s perfect for tech-smart millennials and new investors wanting to grow their wealth.

Key Takeaways – Raiz Invest Review

- Micro-investing platform designed for beginners

- Start investing with minimal capital

- Automated investment strategies

- Diversified portfolio options

- User-friendly mobile application

- Flexible investment thresholds

- Transparent fee structure

What is Raiz Invest and How Does It Work?

Raiz Invest changes how Australians invest by making it easy and accessible. It’s a micro-investing platform that helps you grow your wealth with small, regular investments.

Overview of the App’s Features

Raiz makes investing simple and user-friendly. You can start with little money and build a diverse portfolio. Its main features are:

- Automatic round-ups from everyday purchases

- Multiple investment portfolio options

- ETFs for broader market exposure

- Flexible investment strategies

Introduction to Micro-Investing

Micro-investing changes the game by letting you invest small amounts regularly. With Raiz, you can start investing with just spare change from your daily transactions. It makes investing easy and accessible for everyone.

“Micro-investing turns small amounts into significant savings over time” – Financial Expert

Signing Up for Raiz Invest

Starting with Raiz is easy. Here’s how to get going:

- Download the Raiz app

- Create an account

- Link your bank account

- Choose your investment portfolio

- Set up round-ups

Raiz uses technology to make investing easy. It helps you grow your wealth step by step.

Key Benefits of Using Raiz Invest

Raiz Invest makes it easy for Australians to build wealth. It has over 600,000 users and manages more than $1 billion. This platform changes how people invest their spare change.

Starting your investment journey is simple with Raiz. The app offers a user-friendly experience. It has features that make investing easy for beginners.

Simplified Investment Experience

Raiz lets you start investing with just $5. It offers:

- Nine expertly constructed portfolios

- User-friendly interface for beginners

- Multiple investment approaches

Potential for Wealth Accumulation

Investing small amounts can grow your wealth with Raiz. You can:

- Build long-term financial habits

- Diversify investments across ETFs

- Potentially grow savings without significant upfront capital

“Raiz turns everyday purchases into investment opportunities, making wealth creation effortless.” – Financial Expert

Automatic Round-Ups

The Round-Ups feature invests your spare change. It saves money without thinking about it. For example, a $4.50 coffee could round up to $5, investing the 50 cents.

With clear fees and various investment options, Raiz helps you control your financial future. Start investing with your spare change today.

Understanding the Investment Options

Exploring Raiz for micro-investing opens up a world of choices. These options are tailored to fit your financial goals and how much risk you’re willing to take. You’ll find a variety of custom portfolios that match different investor needs.

Raiz offers nine unique portfolios, each designed for a specific investment strategy:

- Five risk-based portfolios ranging from Conservative to Aggressive

- Emerald portfolio for socially conscious investors

- Sapphire portfolio with bitcoin exposure

- Property portfolio

- Custom (Plus) portfolio for personalized investing

Portfolio Customisation

With Raiz, you can create your own investment plan. You get to choose from 16 ETFs, 50 major ASX stocks, bitcoin, and a property fund. This lets you build a portfolio that matches your financial goals.

Thematic Investing Choices

Raiz is unique with its Eucalyptus portfolio approach. It offers thematic investments that go beyond the usual. The Emerald portfolio focuses on green and socially responsible investments. The Sapphire portfolio gives you a 5% chance to invest in bitcoin.

Risk Profiles Explained

Knowing your risk level is key. Raiz’s default portfolio is conservative, spreading your money across different ETFs. It tracks about 20 ETFs on the ASX, helping to manage your risk.

“Investing is not about perfection, but about making informed choices that align with your financial goals.” – Raiz Investment Philosophy

Whether you’re new to investing or want to mix up your portfolio, Raiz has flexible options. It helps you grow your wealth in a smart way.

How Much Does Raiz Invest Cost?

It’s important to know the fees when you choose an investment platform. Raiz Invest has clear costs that can affect your money and how you invest.

Subscription Fees Explained

Raiz has a simple fee plan for all investors. Here’s what you need to know:

- Accounts under $15,000 pay a flat $3.50 monthly fee

- Accounts over $15,000 pay 0.275% per year

- No extra fees for buying or selling ETFs

Fee Transparency

Raiz is known for its clear fees. Their monthly fees are easy to understand, helping you know what you’ll pay.

“Knowing your fees upfront helps you make smarter investment decisions” – Financial Expert

Hidden Costs to Watch

Even though Raiz is easy to understand, there are some extra costs to keep in mind:

- Withdrawals can take up to five days

- Capital gains tax applies to your investment gains

- No instant bank transfers (24-48 hours wait)

Knowing these fees helps you manage your money better. It lets you make smart choices with Raiz.

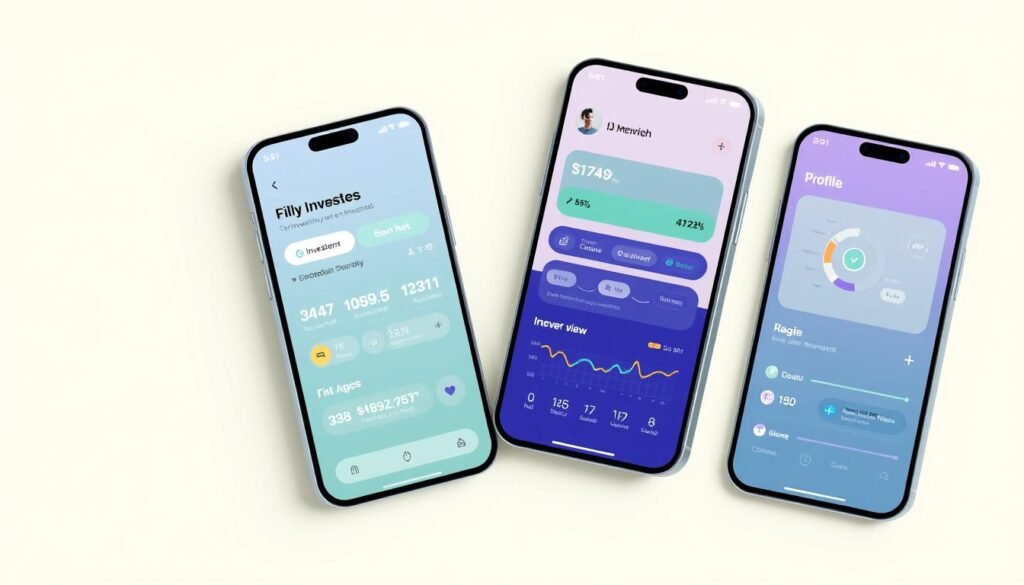

User Experience: Navigating the Raiz App

The Raiz mobile app makes managing your money easy and fun. It has a top rating of 4.7 out of 5 in the app store. This shows it’s all about making things simple and effective for users.

When you open the Raiz app, you see a clean dashboard. It’s designed to make complex money stuff simple to get.

Dashboard Features and Layout

The Raiz app gives you a clear view of your investments. It has:

- Real-time portfolio performance tracking

- Detailed investment breakdowns

- Customizable portfolio views

- Quick access to account settings

Investment Tracking Tools

Raiz has great tools to track your investments. You can:

- View portfolio performance metrics

- Track dividend earnings

- Analyze historical investment data

- Set and monitor investment goals

“Our goal is to help improve financial confidence and assist users in meeting their financial goals” – Raiz Invest Team

Customer Support and Resources

Raiz knows how important support is. The app offers:

- Email support with 1-2 business day response times

- Comprehensive educational resources

- Frequently Asked Questions (FAQs) section

- In-app guidance for new investors

With over 600,000 accounts and 280,000 active users, Raiz leads in Australian micro-investing. Its app is easy to use, making investing fun for everyone.

Security and Trustworthiness of Raiz Invest

Investing your money is a big deal. Raiz Invest knows this and has strong security to protect your money and personal info.

Regulatory Compliance in Australia

Raiz Invest is open and follows strict rules. It has an Australian Financial Services License (AFSL) from ASIC. This means it’s safe for investors.

- Fully licensed and regulated financial service

- Transparent reporting mechanisms

- Compliance with Australian financial regulations

Data Protection Measures

Raiz Invest values your data safety. It uses top security to keep your info safe:

- 256-bit secure encryption technology

- Multi-factor authentication

- SSL protection for online accounts

“We take your financial security seriously” – Raiz Invest Team

User Reviews and Trust Ratings

Raiz has earned trust from many in Australia. It has over 500,000 users and about AUD $1 Billion in investments. People are happy with Raiz, showing it’s reliable.

Raiz Invest focuses on safety, following rules, and making users happy. It’s a top choice for micro-investing in Australia.

Pros and Cons of Raiz Invest

Looking into Raiz Invest shows both sides of micro-investing. It has over 1.25 million signups and 584,000 accounts. This makes it easy for people to start investing.

Here are the main good points and things to think about when using Raiz Invest:

Advantages of Micro-Investing

- Low minimum investment makes financial growth accessible

- Automated investing helps build consistent savings habits

- Diversified portfolio options to match different risk tolerances

- Round-up feature allows effortless investing from everyday purchases

- Potential for long-term wealth accumulation

Potential Drawbacks to Consider

- Higher fees for small account balances (flat $3.50 monthly for accounts under $15,000)

- Limited investment options compared to traditional brokers

- Investment risks inherent in market fluctuations

- Potentially lower returns during market downturns

“Micro-investing is about making investing accessible, not about getting rich overnight.” – Financial Expert

Your investment plan should match your financial goals and how much risk you can take. The average Raiz account has $2,109. This shows it’s good for beginners or those adding small amounts regularly.

Even though Raiz offers a new way to invest with low minimums, it’s important to know both the good and bad before investing.

Raiz Invest vs Other Investment Apps

The Australian micro-investing scene has grown fast, with many apps vying for investors. Raiz Invest shines among these, with features that make it unique.

Spaceship Voyager: A Close Competitor

Spaceship Voyager is a big name in the investment app world, rivaling Raiz. Here’s what sets them apart:

- Raiz has 8 investment portfolios, while Spaceship offers 3

- Raiz has more flexible investment plans

- Raiz charges $4.50 monthly for accounts under $20,000

Exploring Other Market Rivals

CommSec Pocket and Acorns are also worth looking at. Here’s what makes them special:

- CommSec Pocket:

- Starts with a $50 minimum investment

- Charges $2 for trades up to $1,000

- Limits to 7 ETFs

- Acorns (now separate from Raiz):

- Uses a round-up investment strategy

- Has a different fee structure

Raiz’s Unique Selling Points

So, what makes Raiz unique? Flexibility, diversity, and new features. It offers:

- Automatic round-ups

- Raiz Rewards cashback program

- Ethical investment choices

- Portfolios from Conservative to Sapphire (including Bitcoin)

“Raiz provides investors with a user-friendly platform that democratizes investing for everyday Australians.” – Financial Technology Analyst

With over 3 million customers and $1 billion in funds, Raiz has won many hearts in the micro-investing world.

The Tax Implications of Micro-Investing

Micro-investing’s tax landscape can seem tricky. But knowing the basics helps you make smart money moves. When you use platforms like Raiz, knowing about capital gains tax is key.

Understanding Capital Gains Tax

Capital gains tax kicks in when you sell something for more than you bought it for. For micro-investors, keeping track of gains is vital. The Australian Taxation Office (ATO) uses your tax rate to figure out how much you owe.

- Investments held over 12 months might get a 50% tax break

- Your income affects how much tax you pay

- It’s important to keep good records for tax time

Tax Reporting through Raiz Invest

Raiz Invest makes tax time easier with annual statements. These show details like dividends and capital gains. Using smart tax strategies can cut down your tax and boost your returns.

Strategies for Minimising Tax Liabilities

Smart investors use tax strategies to improve their micro-investing. Try holding onto investments for longer to get tax breaks. Also, diversify your portfolio and plan when to withdraw your money.

“Understanding tax implications is key to successful long-term investing” – Australian Financial Expert

By keeping up with capital gains tax and tax reporting, you can make better financial choices. This might even lower your tax bill.

How to Maximise Your Returns with Raiz

Investing with Raiz can help you grow your wealth. It’s all about smart strategies and understanding key concepts. This includes diversifying your portfolio and investing for the long term.

Developing Consistent Investment Habits

Building financial success starts with regular investments. Raiz offers tools to help you stay on track:

- Set up automatic round-ups from daily purchases

- Schedule recurring weekly or monthly deposits

- Use spare change investments to grow your portfolio

Strategic Portfolio Diversification

Spreading your risk is key to long-term success. Raiz has various portfolios to help you diversify:

- Explore different risk-weighted portfolios

- Consider thematic investment options

- Balance your investments across various sectors

“Investing is not about timing the market, but time in the market.” – Unknown

Setting Clear Investment Goals

Your investment journey should match your financial goals. Define clear, achievable goals that fit your risk level and timeline. Whether it’s for a home, retirement, or emergency fund, Raiz helps you track progress.

Remember, investing needs patience, discipline, and a desire to learn. Raiz offers tools for smart strategies that can grow your wealth over time.

Is Raiz Invest Suitable for Everyone?

Getting into micro-investing can be daunting for many Aussies. Raiz Invest is a great option for both newbies and those looking to mix up their investment plans.

Not every investment platform is the same. Raiz Invest stands out for beginners. It’s perfect for those new to the financial world.

Best Fit for Beginner Investors

Raiz is a top choice for beginners. Its easy-to-use design and low start-up costs are great for:

- Young professionals starting their financial journey

- Students wanting to learn about investing

- Individuals with limited investment capital

Advanced Investing Considerations

But, Raiz might not be the best for seasoned investors. It has fewer investment choices than traditional brokerages. Those who can handle more risk might find it too simple.

Age-Based Investing Strategies

Investment strategies should adapt to your life stage and financial goals.

At different ages, people can use Raiz in different ways:

- 20-35 years: Long-term wealth accumulation

- 35-50 years: A good addition to your investment mix

- 50+ years: Options for a more cautious portfolio

Your investment path is unique. Raiz provides a solid base for growing your financial confidence at any age.

Real Stories: User Experiences with Raiz

Looking into real user testimonials gives us a peek into how Raiz has changed the game for Australians. It shows how small, regular investments can lead to big financial gains. This is a new way to grow your wealth.

Success Stories of Raiz Users

Many Australians have found the power of micro-investing with Raiz. Their stories show how easy and simple investing can be:

- Young professionals saving small amounts consistently

- First-time investors building confidence

- Individuals creating additional income streams

“Raiz helped me start investing when I thought I didn’t have enough money to begin,” says Sarah, a 26-year-old marketing professional from Melbourne.

Common Challenges Faced

Even with the good, users have hit some bumps along the way. Some common issues include:

- Understanding fee structures

- Managing expectations for short-term returns

- Navigating market volatility

Lessons Learned from Users

The top tips from Raiz investors are:

- Consistency is key in micro-investing

- Start small but stay committed

- Diversify your investment portfolio

- View investing as a long-term strategy

By learning from these stories, you can make better choices for your own Raiz journey.

Expert Insights on Raiz Invest

To understand micro-investing, we need to look at what experts say and what’s happening in the market. Financial experts have been studying Raiz Invest to see if it’s good for new investors.

Financial Advisors’ Perspectives

Financial pros see Raiz as a great way for beginners to start investing. Dr. Jake An, a key person at Raiz, has helped make it easy for users to invest.

*”Micro-investing platforms are changing how young Australians grow their money,”* says a top financial advisor.

Market Trends Influencing Raiz

Investment trends are affecting micro-investing sites a lot. Important changes include:

- More people want to invest in things that are good for the planet

- Younger people are getting better at managing their money online

- There’s a big need for easy-to-use investment choices

Future of Micro-Investing

The future of micro-investing looks bright. With over 164,000 Australians using Raiz, it’s getting better. Experts think this area will keep growing because of:

- New tech making things easier

- Investment experiences that are simple

- It’s easier for new people to start investing

As things change in investing, Raiz is ready to offer easy, flexible ways for people to start their financial journey.

Frequently Asked Questions about Raiz Invest

Micro-investing can seem tricky. This section answers common Raiz FAQs. It helps you make smart investment choices and grasp micro-investing basics.

Top User Questions About Raiz

Potential investors often ask several key questions about Raiz. Here’s the essential info:

- How much money do I need to start investing?

- What are the fees associated with Raiz?

- Can I withdraw my money at any time?

- How safe is my investment?

Quick Investment Details

Raiz makes micro-investing easy with some great stats:

- Minimum investment: Just $5

- Over 600,000 accounts as of November 2022

- More than $1 billion in managed funds

“Micro-investing is about making investing simple and approachable for everyone.” – Raiz Investment Team

Clarifying Common Misconceptions

Many users get things wrong about micro-investing. Raiz lets you invest flexibly with no lock-in. You can take out your money anytime, but it takes 3-5 days to process.

Where to Find More Information

For all the details on your investment queries, check these places:

- Official Raiz website

- In-app support section

- Product disclosure statements

- Educational resources within the app

Remember, understanding your investment options is key to successful micro-investing. Always look at the latest info from Raiz.

Conclusion: Should You Try Raiz Invest?

Deciding to invest with Raiz Invest depends on knowing its unique benefits. It has shown strong growth, with a 19% revenue jump and 23% more funds managed. This makes it a great choice for Australians looking for easy investment options.

Think about your financial goals when looking at Raiz. It has seven pre-made portfolios and one you can customize. This flexibility suits different risk levels. The platform’s success, like a 66.4% rise in Raiz Plus and a 121.4% jump in Raiz Kids, shows it can help grow your wealth over time.

The app’s financial health is impressive. It has $9.7 million in cash, no debt, and backing from State Street Global Advisors. This makes it a solid choice for both new and cautious investors. Its low entry point and automatic investing features are perfect for starting your investment journey.

Before making a decision, assess your financial situation, risk tolerance, and goals. Raiz Invest is a good way to start investing, but it’s important to understand its fees. Try the app, test its features, and start with small investments to see if it fits your wealth-building plan.

FAQ

How much money do I need to start investing with Raiz?

You can start investing with Raiz for as little as $5. The app makes investing easy, letting you begin with small amounts. You can use features like round-ups and small deposits to start.

What are the fees for using Raiz?

Raiz charges a monthly fee of $4.50 for accounts under $20,000. For balances over $20,000, it’s 0.275% per year. The Plus portfolio costs $5.50 a month for balances under $25,000. There are no extra fees for buying or selling shares in the Plus portfolio.

How do the round-ups work?

Round-ups invest your spare change from daily purchases. For example, if you spend $4.50 on a coffee, Raiz will round up to $5. The extra 50 cents goes into your chosen portfolio. You can link your bank accounts and set up this feature easily.

Can I withdraw my money at any time?

Yes, you can withdraw your money from Raiz anytime without penalties. But, consider market conditions and short-term changes before withdrawing. You can withdraw instantly to your bank account.

What investment portfolios does Raiz offer?

Raiz offers nine portfolio options. This includes five risk-based portfolios and an Emerald portfolio for socially responsible investing. There’s also a Sapphire portfolio with bitcoin, a Property portfolio, and a Custom portfolio with 16 ETFs, 50 ASX stocks, bitcoin, and a property fund.

Is my money safe with Raiz?

Raiz uses top security and data encryption to protect your info. Your funds are insured against fraud and criminal activity. Online accounts are secured with SSL encryption and multi-factor authentication. Raiz is regulated by Australian financial laws.

Can I use Raiz for long-term investing?

Absolutely! Raiz is great for long-term investing. It encourages consistent, small investments and offers diversified portfolios. The more you invest, the better your long-term returns.

Are there any tax implications when investing with Raiz?

Yes, Raiz investments are subject to capital gains tax. This tax is based on your marginal tax rate. Raiz provides tax statements to help with your taxes. Holding investments for over 12 months may qualify for tax discounts.

How does Raiz compare to other micro-investing apps?

Raiz is unique with its round-up feature, diverse portfolios, and Raiz Rewards cashback. Compared to Spaceship Voyager and CommSec Pocket, Raiz offers more investment choices and a user-friendly interface for Australian investors.

Is Raiz suitable for experienced investors?

While Raiz is great for beginners, it might be limited for experienced investors. The Custom portfolio offers more flexibility, but advanced investors might prefer traditional brokers. It’s a good tool for adding diversification to your portfolio.