Since its inception, Youhodler has been a popular destination for those looking to invest in cryptocurrency. The site has a wide variety of options for investment, making it a great choice for newcomers and experienced investors alike. In this Youhodler Review, we’ll take a closer look at what Youhodler has to offer and how it can benefit you.

There are many cryptocurrency investors and traders that use their funds to buy and sell currencies. For those who want to get involved, there is not a good way to borrow and lend using other sources. However, the new technology allows you to do so by using smart contracts.

It’s not just cryptocurrency that’s attracting interest. Youhodler makes it possible for people all over the world to borrow money using their crypto assets as collateral while keeping their private keys safe at all times.

Exchanges allow investors to sell fiat currencies for cryptocurrencies. In the case of Bitcoin, for example, investors can sell fiat currency (USD) in exchange for bitcoins.

Who Is YouHodler?

YouHodler is a crypto currency exchange that specializes in crypto lending and high interest savings for the cryptocurrency Hodler. The company is located in Limassol, Cyprus and was awarded the recognition of an official member of the Blockchain Association by the Financial Commission.

What Do They Offer?

YouHodler is a crypto lending platform that offers interest rates that range between 1% and 15%, depending on the coin deposited. Users have the option to borrow BTC, ETH or BCH.

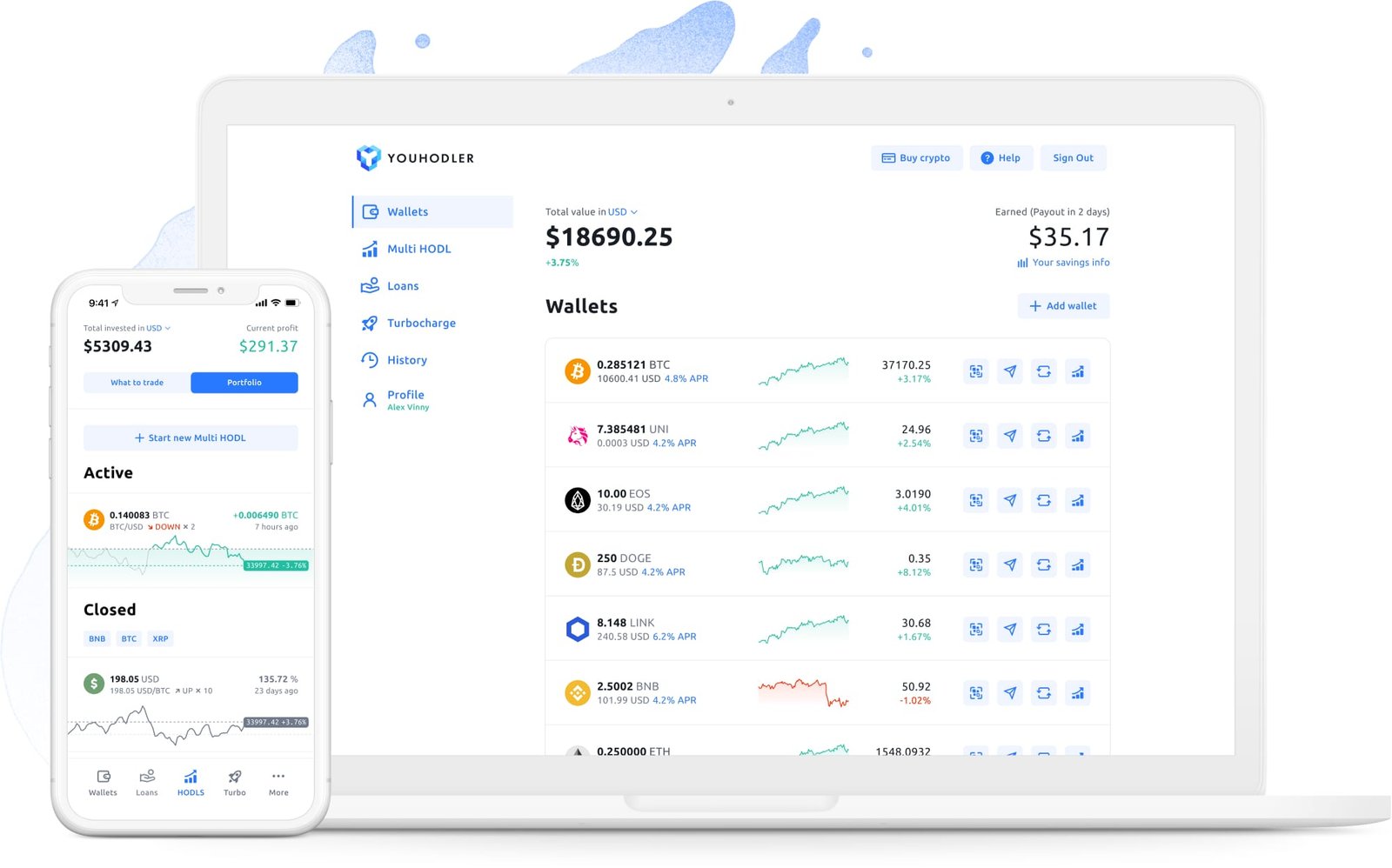

The crypto lending platform, that is, what makes up the crypto loans. The company is a mobile app that allows investors to borrow money in exchange for crypto-currencies.

You may also use YouHodler’s mobile app to store your tokens or buy ERC20 tokens on it.

Earning Interest On Crypto

Cryptocurrencies can be purchased and then held for a long period of time. That’s the traditional way to invest in Bitcoin or any other cryptocurrency, but it doesn’t work for standalone cryptocurrencies. Instead, the best strategy to make money is to use a trading strategy that works for any coin.

If you want a place where you can loan out your coins then YouHodler is the place for you. By simply lending your coins, you could earn from 3% up to 12% per year in interest payments.

Interest is compounded every week and the minimum balance required to earn interest is $100. This means that if you don’t make a withdrawal or deposit, the amount of interest earned on your balance will be less than what is required to pay you.

Multi HODL to Multiply your Profits

Multi-Hodling allows you to diversify your portfolio. This means that you can spread your risk and potentially increase the amount of return on your investments. How this works is not exactly clear but the website explains it in a way that is easy to understand.

The idea for this investing strategy is derived from the concept of “The Barbell Strategy.” Investors keep 90% of their assets in a risk-free savings account, but they also invest the remaining 10% in high-risk, high-yield initiatives.

If you don’t understand the math behind cryptocurrency, here is a summary of what you need to know about cryptocurrency in 10 minutes:

With MultiHODL, users are able to use a system that allows them to keep an optimal amount of their tokens and utilize the turbo feature to quickly add more.

Investors may control risk by adjusting the PDL to what they believe is the best choice for their situation. As a result, you are certain about what kind of risk matrix you are entering into.

Crypto Loans

YouHodler offers loans in both fiat and crypto currencies. Loans are secured (i.e., backed) with either currency, and there’s a 90 percent maximum loan-value ratio, which is much higher than most crypto lenders’ limitations.

You can choose to borrow in cryptocurrency or fiat currency (EUR, USD, CHF, and GBP) or you can choose to withdraw your money to a credit card or bank instantly.

After the loan has been paid back, your assets will be returned to you. Aside from merely repaying your loan, there are three additional ways to terminate it:

Close Now — Your collateral is used to pay off the loan and you get whatever is left over.

Reopen — You can extend your loan when it is getting close to its expiration date. This isn’t the same as terminating a loan; it’s more like rolling into a new one. The same conditions from the previous loan will apply. There is also a small cost for the new loan.

Walk Away — You can walk away from the loan agreement if your LTV is 90%. You’ll get 85% of your collateral back.

Both the Close Now and Reopen choices are subject to charges. Depending on how long you want to borrow, you may choose from three different loan terms:

30 days: LTV of 90%

60 days: LTV of 70%

180 days: LTV of 50%

YouHodler features a “Price Down Limit” or PDL, which is similar to a margin limit. This is the minimum price that your collateral must not drop below. If your assets fall below the PDL, YouHodler has the option of selling them and closing out the loan.

You may restrict the PDL and modify the loan conditions if you like. If your collateral’s worth falls below the PDL due to a drop in the value of your coin, you may always add more crypto to keep the loan open.

Is YouHodler a Safe Platform?

The YouHodler supports secure storage of valuable cryptocurrencies with LedgerVault. If the user’s assets are worth more than $10,000, three-factor authentication may be enabled. The user can also use this authority outside the platform for dispute resolution.

This platform adheres to EU norms and laws, giving it an advantage over other platforms in terms of legality. It also monitors transactions and prevents criminal activities such as money laundering and fund brokering for terror.

YouHodler Security

YouHodler takes security very seriously and is the first cryptocurrency exchange to have achieved full Swiss banking license. In addition to having a safe cold storage system, they also employ best practices in cybersecurity and regularly monitor their servers for any attacks.

YouHodler, the world’s leading security provider, protects its customers’ money and offers a third-party multi-authorization self custody option for its customers.

YouHodler Customer Support

When compared to other crypto lending platforms, YouHodler provides the most helpful customer care. A special help area is available where customers can discover how specific products work and what conditions apply to their loans.

Users may contact us by chat, phone or e-mail.

YouHodler Alternatives

Conclusion

YouHodler is a legitimate service that provides many perks for cryptocurrency users in various ways. It is the ideal borrowing platform for those seeking to earn interest rather than leave their funds in their wallets. However, YouHodler does not allow borrowers to borrow the full amount of their cryptocurrency, instead only allowing a fraction of its worth to be borrowed.

If you’re looking for a quick loan to tide you over until your next payday, YouHodler is the place to go. It allows users to store their cryptos instead of selling them. This opens up a slew of new possibilities for them to save their coins. No longer do they have to sell their crypto coins if they need money; they can borrow cash with a low interest rate and pay it back later.